The reconciliation module is responsible for maintaining the integrity of the financial data by comparing the data in the super-app system reports against the data in parallel system reports. This process helps identify any discrepancies between the two sets of data and allows the system to reconcile any gaps.

Counters

The transaction counters module, on the other hand, is responsible for managing all applicable counters in the system. These counters can be related to accounts, products, promotions, or services and are updated and recorded by the module to prevent conflicting updates that can occur if updates are executed from different sources. The module should handle counters for successful transactions by increasing the counter and adjusting the counter for failed, rejected, or reversed requests.

Scoring

Credit scoring is a term commonly used to describe the statistical analysis conducted by financial institutions and lenders to evaluate the creditworthiness of individuals or small, owner-operated businesses. By leveraging credit scoring, lenders can make informed decisions on whether to extend or deny credit.

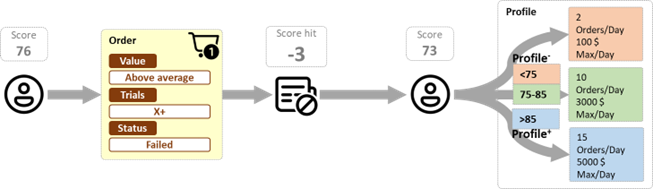

In the context of your visionary ecosystem, credit scoring plays a crucial role in determining credit limits for accounts through financing partners. Additionally, the ecosystem leverages the score by linking it to the profile module, allowing for dynamic handling of account upgrades or downgrades -Profile+ and Profile– limits- based on changes to the rating or score.

This dynamic handling is a key part of the ecosystem’s internal system fraud prevention rules, which are designed to ensure strong security and fraud controls. This is particularly important given that the super-app ecosystem processes millions of transactions on a daily basis. By blocking fraudulent activities, the ecosystem maintains the trust of connected customers and businesses, further bolstering the system’s credibility.

It is important to note that credit scoring and fraud prevention are just two aspects of maintaining a reliable and secure financial system. Other factors that should be prioritized include data privacy, regulatory compliance, and robust cybersecurity measures. By prioritizing all of these factors, our ecosystem will continue to provide a secure and trustworthy platform for financial transactions.

Reporting and settlement

In a super-app ecosystem, reporting and settlement modules play a major role in ensuring transparency and accuracy in financial transactions. The reporting module generates detailed reports on transaction history, allowing users to track their financial activity and identify any discrepancies. These reports may include information such as transaction amounts, dates, and account balances. Additionally, the reporting module may provide analytics and insights on user behavior and spending patterns, allowing businesses to make data-driven decisions and improve their offerings.

Meanwhile, the settlement module is responsible for processing and reconciling transactions between different parties, such as merchants and customers. The module ensures that all transactions are settled accurately and in a timely manner. Settlement may involve transferring funds between accounts, reconciling payment data, and verifying the authenticity of transactions. By automating settlement processes and providing real-time updates, the settlement module helps reduce the risk of errors and delays, improving the overall efficiency of the ecosystem.