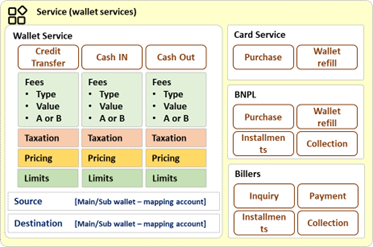

To maintain a dynamic design, a service module is built to complement the account concept, thinking about service as the same way we trade on a daily basis. Paying at a POS machine moves funds from our card account to the merchant’s linked bank account, while paying money to friends involves cash flowing from our pocket to theirs.

Service

Service contains all products with the same integration endpoints, including source, destination, and inquiry interfaces if they exist. This design minimizes costs and efforts when it comes to technical upgrades or service migration in addition it lowers the impacted products while developing new features or even fixing a technical bug.

Product

Product is inherited from a service and has its parameters, which give each product its characteristics.

Service VS product

With the card service example shown in the diagram, the service debits the customer’s provided card account and credits the system wallet account, either in a wallet refill action or purchase request. This is counted as the generic definition of the card service. Coming to the illustrated products example, the purchase is configured independently from the refill activity, allowing the following:

- Flexibility to set different limits for daily and monthly usage for each product

- Charge each product with a unique pricing scheme

- Calculate taxation for each product separately

Source & destination

The fund or transaction source defines the service source account to be used in this type of request. The source could be the internal system main or sub-wallet, the mapped bank, card, BNPL, loyalty, or financing account. The same goes for the destination account, which is the second transaction leg.

Fees

Product fees define the charges applied to these product orders. They might be applied on A, B, or both parties simultaneously. Additionally, fees are calculated as fixed, percentage, tiered, or slabs, to cater for the most known charging techniques.

Limits

Similar to previously explained account limits, daily and monthly counters and accumulated usage control exists per product.

Tax

Finally, a taxation module is added to allow an additional charge for all taxation applied to users directly. Worth highlighting that it’s recommended that all taxes paid by the ecosystem provider should be calculated separately within a taxation specialized system.

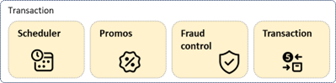

Transaction module

By using a unified module to execute all transactions, the payment process is streamlined and every single transaction is ensured to go through the necessary calculations, charging, controls, and reward checks if applicable.

Scheduler

In addition, the payment application features a scheduler that enables customers to set up recurring payments, which is a common scenario for those who have regular bills or payments. This allows customers to automate their payments, saving them time and effort. Customers have the option to manually initiate transactions or pre-approve recurring payments for added convenience.

Moreover, the application provides customers with the ability to set a transaction capping limit. This feature allows bills that fall below the defined capping value to be executed directly. Bills that exceed the capping value require additional approval from the customer, giving them greater control over their finances. By providing this level of flexibility, the payment application empowers customers to manage their payments in a way that works best for them.

Promotions

For all developed use cases the ecosystem should have the option run set of defined promotions to reward selected transactions parties, the reward or promotion itself will vary according t the marketing agenda and may have some of the below common rewarding scheme,

To incentivize users to make transactions within the ecosystem, the payment application should have the capability to run a set of defined promotions. These promotions can be tailored to fit the marketing agenda and can offer various types of rewards or incentives to selected transaction parties. Common rewarding schemes include,

- Waiving or discounting fees.

- Offering cash back or other incentive rewards.

- Providing discounts on partner services or products.

- Distributing discount vouchers.

- There may also be other applicable rewarding options, depending on the specific needs of the ecosystem.

By offering these rewards and incentives, the payment application can encourage users to engage more frequently and actively within the ecosystem. This can not only increase customer satisfaction but also help to drive revenue growth for the ecosystem’s partners and stakeholders.

Fraud control

Operating a super-app ecosystem comes with inherent fraud risks, and it is essential to have robust self-defense algorithms and techniques in place to prevent potential fraudulent transactions. While fraud checks are typically handled by separate systems that can perform deep network and behavioral auditing, having real-time defensive tools can help capture trends in increasing fraudulent activity or repetitive patterns across registered accounts.

By implementing real-time defensive tools, the payment application can quickly identify potentially fraudulent activity and take action to prevent further harm. This may include blocking specific services or raising an alert flag that brings the attention of fraud experts to manually check and validate the case for possible fraud attacks.

The ecosystem’s self-defense algorithms and techniques should be continuously updated and improved to stay ahead of emerging fraud trends and techniques. By investing in robust fraud prevention measures, the ecosystem can build trust and confidence with its users and partners, while minimizing financial losses and reputational damage associated with fraud.

Transaction

The transaction module is a critical component of any e-commerce platform, as it oversees the order execution process from start to finish. It begins by applying the service logic to the order, ensuring that all requirements are met and the customer’s needs are fully addressed. Following this, the module calculates the fees and taxes associated with the transaction, taking into account any applicable regulations and guidelines.

To ensure that customers receive the best possible value for their purchase, the transaction module also checks for any promotions or discounts that may apply. This helps to build customer loyalty and satisfaction, which is essential for the long-term success of any e-commerce platform.

Finally, the transaction is subjected to a robust fraud monitoring tool to identify any potential fraudulent activity. This step is critical to maintaining the security and integrity of the platform, as well as protecting the interests of both customers and merchants.